Much has been said about Black Friday this year, with predictions of poor performance due to the World Cup, cost of living crisis and an extremely price-conscious consumer.

But what does the actual data reveal?

In this report, we’ve collated findings from our own client accounts and Google Trends, as well as sharing some of the key tactics we saw throughout the month. Read on for indepth insights, or jump ahead to see our quickfire recommendations for any upcoming sales periods.

What have we seen in our accounts?

For all the negative messaging around Black Friday this year, results have been overwhelmingly positive for our clients:

- Generally, ecommerce brands that ran a sale saw revenue increase from last year, with some as high as 172%!

- One of our clients enjoyed a record-breaking year for November sales exceeding their best-ever sales period by 20%

- Clients running extended sales saw a significant spike the week before Black Friday (‘Fake Friday’) and this didn’t prevent strong sales on Black Friday

Those who ran extended sales saw revenue dip between Fake Friday and Black Friday. Surprisingly, one of our clients actually took 7.5% more revenue the week before Black Friday, when their sale went live. Proving that shoppers who are primed and ready to buy are happy to pounce on early deals, while others won’t commit until the ‘big event’ in case the discount improves.

It’s also worth noting that many of the sales we pushed didn’t feature dramatic price slashes, yet they still delivered plenty of revenue, with shoppers having enough of an incentive to get the sale over the line.

In the coming weeks we will analyse this further to understand if this caused a softer start to November, with potential customers waiting in the wings for the sale to start?

What can Google Trends tell us about Black Friday 2023?

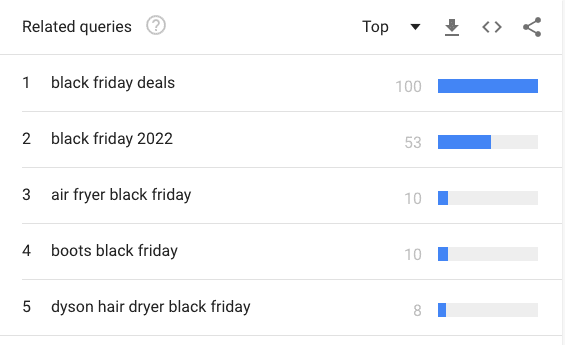

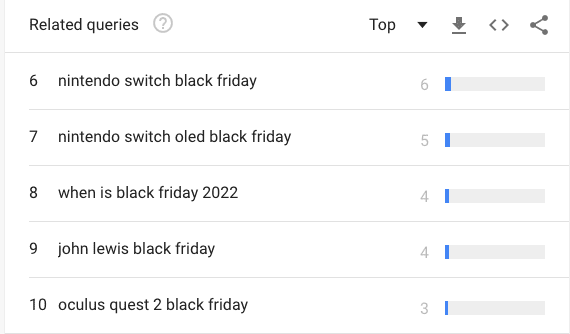

Prior to the weekend, there were predictions of waning interest in Black Friday – which Google Trends data does support. This year, the early signs are pointing to fewer people searching for ‘Black Friday deals’ than in the last five years – but it was still a top search term, often appended with specific brands or in-demand products, like games consoles.

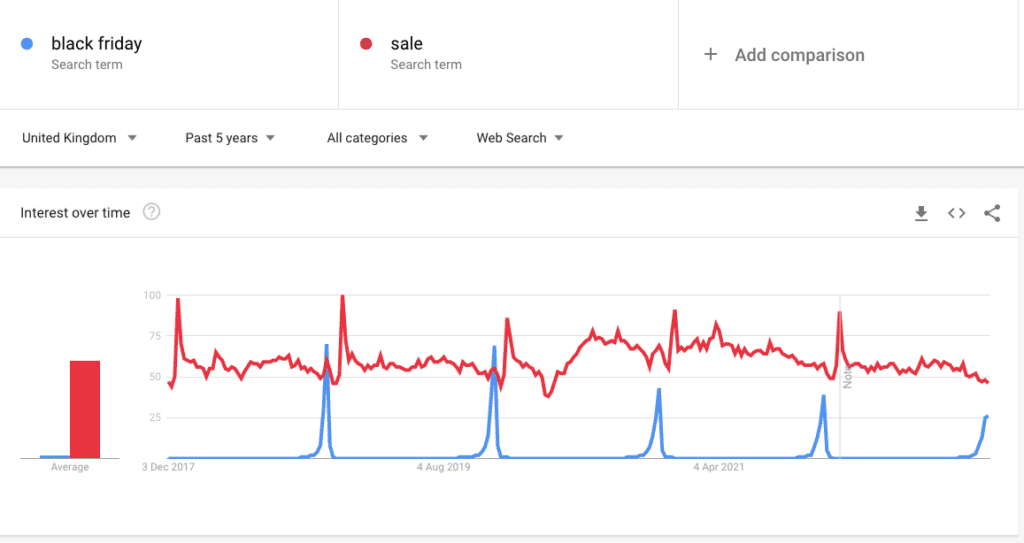

Black Friday vs ‘Sale’ as a search term still pales in comparison in the UK as you can see in the diagram. The last three years have seen ‘Black Friday’ still enjoy relatively consistent spikes, but it’s the Boxing Day and January sales that reign supreme – naturally, since this is a bank holiday in the UK.

Key 2023 Black Friday sales tactics

Of course, looking at search is to say nothing of the huge amount of emails, push notifications, television, radio and out-of-home advertising that goes on around Black Friday, which simply isn’t visible via Google Trends.

It’s expected that inboxes implode in the lead-up to Black Friday weekend – but what was new this year?

- Time-limited sales

Plenty of brands employed a ‘Sale percentage drops the longer you wait!’ tactic to drive incentive and create urgency, rewarding those who landed on the site sooner. - World Cup messaging

The England VS USA game may not have been much to get excited about in the end, but we did see a few more deals around the match – including ‘Discounts for the next 90 minutes!’ ahead of kick-off. - Black Friday boycotts and greenwashing

In an age where consumers are becoming increasingly eco-conscious, some brands ran messages boycotting the shopping spike. A good sentiment, but one increasingly devalued by those brands with no green credentials. Where it aligned with brand values, the response was positive.

- Donations, not discounts

Some brands donated a percentage of profits to charity instead of giving the saving to customers. The sentiment is nice, but one we’d be interested to see more data given the particularly price-conscious shopper this year.

Perhaps the biggest repeated trend though, was the sale period extension. 2022 was a landmark year for uncertainty around Black Friday. Will sales be down? Will customers spend less due to the cost of living, or more because of the savings? How will ecommerce perform versus 2021?

We saw more retailers offering early access to deals, or extending sales periods to last the whole week, or even month – and you can understand why. It’s a real tightrope walk between risking consumer fatigue and overwhelm, while giving brands and businesses an opportunity to manage supply and spread profits out throughout the month.

In the UK, electronics giant Currys has long been a market leader for this approach. Discounts run the whole month, with a price promise of ‘you won’t find it cheaper elsewhere’. The strategy gives consumers confidence, while Currys enjoys traffic throughout the month – although even by their own admission, they still get massive spikes on the day itself.

What does this mean for upcoming sales and Black Friday 2023?

So what should you actually do with all of this information? Here’s our advice:

Decide your messaging direction early

Messaging is key to consumers understanding how – and if – you’re going to run a sale. Time-sensitive sales create urgency, while longer sales with price promises provide reassurance and time to research. Which fits your brand?

Take time to research when defining your offer

Whether or not to run a sale or offer is a unique decision to each brand. Demand is one thing, but product value, brand values, and competitor offers should each play a big role in defining your sale proposition. For example, if direct competitors are providing 20% off sitewide and you’re offering free delivery, which do you think customers will choose?

Plan ahead!

The post-festive period in the UK is incredibly lucrative for sales. Shoppers are looking to snap up deals on gifts they didn’t get, treat themselves in the new year, and spend vouchers. Use insights from other sales periods, like Black Friday, to inform how you run your next sale.

So all in all, while trends have been pointing to decreasing interest in Black Friday, it’s been a profitable period for our clients. That should come as encouraging news for brands as we head into the winter – we’ll keep you posted with more analysis and updates via the blog. Sign up for insights if you want to receive them direct to your inbox!: